Retirement expert Cassie Crowe provides some tips on how to power up your super during the Covid-19 pandemic.

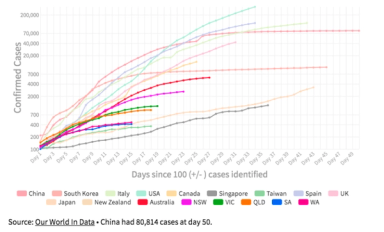

Today we are in the midst of an unprecedented crisis and it’s inescapable. Covid-19 is a pandemic not experienced since the Spanish flu a century ago. In time it will end, however, with a recession looming in the first and second quarters of 2020 and more significantly loss of life, society is facing a heartbreaking journey.

Reference; https://www.covid19data.com.au/ as at 6th April 2020

What does this mean for super?

Superannuation helps people save for retirement. The Government has recognised that for those facing financial hardship due to Covid-19, accessing some of their super today may outweigh the benefits of maintaining those savings until retirement. This is a harsh reality to accept, as those drawing on their super are likely those who will need it most later in life. However, we must do what is required to live our lives today.

Retirement today – 40% of single women retire in poverty

When looking at retirement in Australia today, for a country with one of the world’s most sophisticated super systems, we see some shocking retirement outcomes. For example, while the average retiree has been recently reported as self-funded:

- Almost 45% of females aged 65-69 have no superannuation1

- 40% of older single retired women live in poverty 2

- Female graduates earn $5,000 less than male graduates in the same role2

- Women working full-time earn 18% less than men on average2

- Women take on average five years out of the workforce to care for children or family member which can cause their super savings to stagnate and begin to fall behind

In need of some good news? Super is your super power!

Fortunately, every crisis promotes innovation. Through fusing e-commerce and technology you can now grow your super and earn cash contributions directly in your chosen super fund when you buy life’s essentials online. For example, shop at Woolworths online (or other affiliate partners) via Super Rewards digital platform and when you spend $200 earn $2 (up to a maximum of $5 per shop) directly into your super. This may sound small at first but as Paul Kelly famously sang; from little things big things grow.

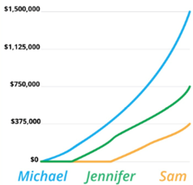

Compound interest example

The below chart has an upward trajectory, as does the one above, but this one is your super and retirement journey improving!

Michael, Jennifer, and Sam each saved $120,000, over a 10 year period, but at different life stages.

Reference; https://www.moneyunder30.com/power-of-compound-interest

Michael - saved $1,000 per month from the time he turned 25 until 35. Then he stopped saving but left his money in his investment account where it continued to accrue 7% until he retired at 65 = $1,444,969 (the largest outcome)

Jennifer - held didn’t start saving until 35. She put away $1,000 per month from her 35th birthday until 45. Like Michael, she left the balance in her investment account, where it continued to accrue at a rate of 7% until 65 = $734,549 (-40% vs Michael)

Sam - only started investing at 45. Still, she invested $1,000 per month for 10 years, halting her savings at age 55. Then she left it to accrue at 7% until her 65th birthday = $373,407 (-70% vs Michael)

3 practical tips to improve your retirement despite Covid-19

- Have one super account: having multiple accounts means it is hard to keep track of how much super you have, and you’ll likely be paying multiple fees eroding your retirement savings.

- Seek advice: most funds have an advice service. Contact your fund and ask questions, seek further clarification if you don’t understand – it’s often complex.

- Grow My Money: sign up to Grow My Money. It’s free, secure and easy, and you can earn cash directly into your super when you shop on-line.

Take charge & power up your super when buying the essentials

At some point when we see infections stabilise, perhaps enough herd immunity develops or preferably scientists create a safe and accessible vaccine, I believe society will recover. But no doubt we will be forever changed. Loved ones will be lost, agile ways of working will be adopted in the industries that make it through and super and retirement outcomes will still be wavering for many. In this volatile environment, why not take charge of what you can?

At Super Rewards, we believe in empowering both women and men facing challenging retirement outcomes. Super is your super power.

Cassandra Crowe, CFA

Grow My Money, Adviser

Close the super gap. Live life.

Cassandra Crowe is a finance professional that is focused on the end investor and improving retirement outcomes. She spent the last 18 years getting to know clients of every kind across Australia, Europe and the UK.

In her spare time she contributes to the CFA Society of Sydney as Director and board member working to promote ethics, professional standards and diversity as the Future-of-Finance.

References;

1 Superannuation Account Balances by Age and Gender, ASFA Research and Resource Centre, October 2017