Superannuation is an essential part of retirement planning. However, it can be hard to contribute to your super if you've left the workforce or have yet to work full-time. That's why Grow My Money exists – and this blog will explain what they are, how they work and how you can use them to grow your super even when you aren't in employment.

Who is Grow My Money?

Grow My Money is a cashback rewards program that helps Australians achieve financial independence faster. Formerly Super-Rewards, Australia's most rewarding superannuation cashback program, the program has now expanded to help users pay off their mortgages sooner. Grow My Money offers over 500 of Australia’s leading online retailers, covering key categories of groceries, fashion, travel, beauty, electronic goods, and so many more. Key online brands in the line-up include Apple, Catch, eBay, THE ICONIC, The Good Guys, Adore Beauty, Appliances Online and Freedom.

In addition to their online offering, Grow My Money enables shoppers to earn super when they shop at over 400 retailers, representing 1000+ physical stores nationally. With cashback offers of up to 15%, key everyday brands in the instore offering include Pizza Hut, Salt Meats Cheese, Pablo & Rusty’s and various pharmacies, while popular home & fashion retailers include General Pants, Ecodownunder and Glue Store. You can earn superannuation cashback by doing the shopping, running errands, or buying items for the household. This means you add to your retirement savings without having to find a job or take on extra work outside of the home.

How does Grow My Money work?

We’ve partnered with great retailers to ensure you’ll be rewarded whenever you shop online or in-store at a Grow My Money retailer. These retailers pay cashback rewards - also known as commissions - to us, and we share them with you. It's their way of rewarding you for your loyalty to their brand.

You can earn cashback via our website, browser extension, in-store or via our cashback app. To start earning now, the easiest way is to download the Grow My Money cashback app from the App Store or Google Play Store and create an account.

Then head to ‘My Account’ and link your existing debit or credit cards – up to 5 of them. It’s free to join. No upfront charges.

Here’s a quick walkthrough of the Grow My Money cashback app to explain how it works:

1. After signing up or logging in to shop online, head to our Popular Retailers page to browse some of our amazing brands. Alternatively, you can scroll through our 500+ online retailers and simply tap on the retailer that you’d like to shop at.

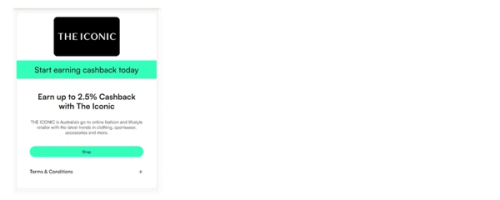

2. You will then see a tile that looks like this.

You can see the amount of cashback that they’re offering and read any T&Cs they have.

3. Now, all you have to do is hit ‘Shop’ – and you shop online as normal. Remember that purchases must be made on the retailer’s website (not their app) to earn cashback.

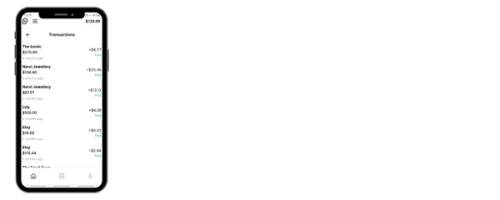

4. Once you’ve purchased your items, you’ll see your cashback amount appear on your dashboard, usually on the same day, but occasionally, it can take longer. You can file a Missing Transaction claim here if you don’t see your purchase on your “My Cashback” dashboard in your Grow My Money account.

5. When your cashback moves to Paid, they will be paid into your super or mortgage account in the next payment cycle – provided you have linked your mortgage, offset or superannuation account to your Grow My Money account.

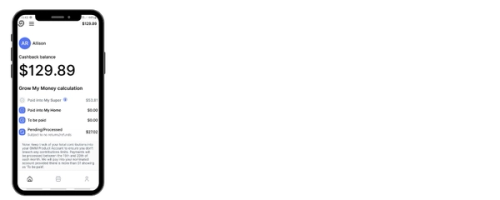

Rewards tracking feature

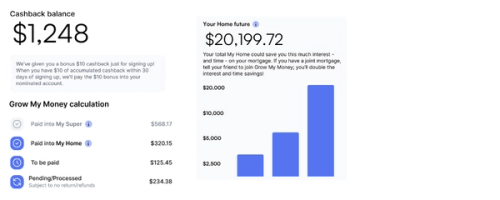

All your in-store or online purchases are reflected in your Grow My Money dashboard. You can see below from this Grow My Money dashboard extract that the cashback earned now is worth so much more by the time you retire. On the left, we have the present-day value of the earned Grow My Money. On the right, we can see how much this $1,248 can grow to over a 30-year term.

**Assumes your “Paid into My Home" amount plus $30 further cashback rewards paid monthly, a loan amount of $500,000, 30-year term, monthly repayments and annual interest rate of 6% p.a. Source: moneysmart.gov.au

With more people leaving traditional employment and taking on gig work or freelancing opportunities outside of the workforce, finding ways to supplement income during retirement is becoming increasingly important. Thanks to cashback apps like Grow My Money, users can now access tools that allow them to grow their super even when they aren't employed in full-time positions – giving them greater financial security during retirement.

Whether you're looking for additional income sources now or preparing for later life, using Grow My Money may be one way to supplement your existing income streams and build up your nest egg over time - without working full-time hours outside of home commitments. Shop via our website, in-store, card-linking or download the Grow My Money cashback app from Google Play or the Apple Store today.

With Grow My Money, you can also turn your shopping cashback into mortgage repayments or alternate between cashback to your mortgage or your superannuation. Find out more here.