The gender super gap in retirement savings in Australia is a growing concern. Women are in a disadvantaged position when it comes to superannuation savings, which is impacting their quality of life in retirement. Women are disadvantaged when it comes to their superannuation savings; this disadvantage, brought about by the gender super gap, means that many spend their senior years in poverty. This article explores how the gender super gap affects retirement savings and suggests actionable steps that women can take to create more financial stability in their later years.

Why is the gender super gap still a problem for many Australians?

Let's delve deeper into the impact on retirement savings. Women are more likely to experience career breaks to care for family members. They are also more likely to hold lower-paid and part-time jobs, contributing to lower superannuation balances. In fact, women are still paid less than men for doing the same job. According to Workplace Gender Equality Agency (WGEA), Australia's total remuneration (including bonuses, overtime) gender pay gap is still stubbornly high at 22.8%. This means that for every $1 on average a man earns, women earn 77.2c. Over the course of a year, that difference adds up to $25,596. It's simply unacceptable. But the problem doesn't end there. Unequal pay leads to unequal retirement savings, too. Women, who typically earn less and take more time off work for caregiving, end up with significantly less superannuation than men. According to WGEA, the median man aged 60-64 has $270,170 in superannuation, while the median woman has $157,049, or about 42% less. Hear more from our founder Pascale Helyar-Moray talk about how Grow My Money helps bridge Australia’s gender super gap.

How Grow My Money can help bridge the gender super gap

It's not all doom and gloom, though. There are actionable steps that women can take to alleviate the gap's impact on their financial stability during retirement. Grow My Money cashback program was created as an innovative solution to bridge the gender super gap and support everyday Australians in achieving financial security through an activity they already perform – shopping! With the Grow My Money program, women can earn cashback simply by shopping at their favourite stores. These too-good-to-be-true rewards are then converted into super contributions to help boost their superannuation balance. The program is partnered with hundreds of retailers across Australia, so whether you're online shopping for groceries and clothes, or even booking a holiday, you can earn while you spend. This consumer-friendly initiative not only offers an easy way for women to bridge the gender super gap but also empowers them to take control of their financial future. Essentially, Grow My Money combines savvy spending with sensible saving to create a unique customer-centric solution to address the prevalent gender super gap issue.

What is the Grow My Money program?

Grow My Money rewards Australians for shopping at participating retailers by putting money into their nominated superannuation accounts. With over 1000+ participating brands, ranging from major food retailers to fashion outlets and travel providers, you can easily find places to shop and put more into your super with the click of a button. When you shop with a Grow My Money retailer online or in-store, the retailer will pay your cashback rewards into your Grow My Money account, which we then pay into your super fund. Since its inception in 2019, Grow My Money has helped thousands of Australians boost their superannuation balance in an easy and fun way. Grow My Money has now expanded to offer cashback towards paying down your mortgage. Find out more about our mortgage cashback program here.

How does Grow My Money work?

It's easy! Simply create a free account on the Grow My Money website and link it to your chosen superannuation fund (or mortgage account). Then, make a purchase at one of the many participating retailers online or in-store, and once verified, the cashback reward will be visible on your Grow My Money dashboard. The amount of cashback varies between retailers but can be as high as 15%.

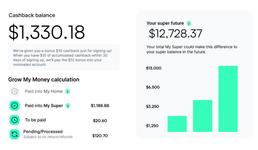

Grow My Money shoppers know that every dollar earned now is worth so much more in retirement. The dashboard example below shows the present-day value of earned Grow My Money on the left. On the right, we see how this amount of $1,330.18 can grow to $12,728.37 over 25 years. *

*Assumes your “Paid into My Super" amount plus $30 further cashback rewards paid monthly, compounding monthly, 25 years to retirement, a median net return of 7.4%p.a. (over 10 years, balanced fund category to 31 December 2021 (ChantWest)). Source: moneysmart.gov.au

Other steps to plug the super gap

Women can seek professional financial advice to optimise their superannuation savings by exploring different strategies such as salary sacrificing, using personal contributions, and consolidating super accounts. It's important to take an active role in managing your retirement savings to secure a comfortable lifestyle in your golden years.

Clearly, the gender gap in superannuation savings is still a significant concern affecting the financial stability of women in Australia. Women are more likely to experience career breaks, hold part-time jobs, and earn less than men, leading to lower super balances. However, there are actionable steps women can take to plug the gender super gap, such as using Grow My Money to help reduce the superannuation shortfall, seeking professional financial advice, and actively managing your retirement savings. By doing so, you could secure a comfortable lifestyle in your final years, free of financial stress and worry. Sign up to Grow My Money today and start plugging your own super gap.

This blog contains general advice only and does not take account of an individual’s objectives, financial situation or needs. Before acting on this general advice, individuals need to consider its appropriateness having regard to their objectives, financial situation or needs and should seek their own independent advice.