In today's world, saving money and managing finances are becoming increasingly important. One way to help achieve these goals is to use a cashback app, such as Grow My Money.

A cashback app is a tool that allows you to earn cashback rewards for making purchases through the app. These rewards are typically a percentage of the purchase price and can vary depending on the retailer and the app. Grow My Money is no exception, offering cashback rewards of up to 15% or more on purchases made through the app.

What makes Grow My Money different from another cashback app?

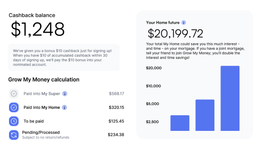

Grow My Money has a unique feature that differentiates it from other cashback apps. The cashback you earn is delivered directly into your mortgage account or superannuation fund to help pay down your mortgage or grow your superannuation. This is a game-changing feature for those looking to pay off their mortgage faster or grow their superannuation for retirement. Instead of receiving cashback rewards as a gift card or cash deposit, Grow My Money allows you to put those rewards towards your long-term financial goals.

For example, let's say you earn $50 in cashback rewards from your purchases through the app. Instead of receiving that $50 as cash, it would be deposited directly into your mortgage account or superannuation fund. Over time, these small rewards can add significant savings to your mortgage or a bigger retirement nest egg. The finance influencer, SugarMammaTV, has calculated potential savings on your mortgage, and SuperGuide offers valuable insight on boosting your super balance with Grow My Money.

With this first-of-its-kind feature, Grow My Money is not just a cashback app but a tool that can help you achieve your financial goals. By putting your cashback rewards towards your mortgage or superannuation, you can accelerate your progress towards financial freedom and security.

5 reasons to get the Grow My Money cashback app

1. Convenience

With Grow My Money, you can shop at your favourite retailers from the comfort of your own home. The app partners with a wide variety of popular retailers, including Big W, THE ICONIC, The Good Guys, Flight Centre, and more. This means you can save money on everything from clothing to holidays, all with just a few clicks on your phone.

2. Free and easy to use

Cashback apps like Grow My Money are designed to be user-friendly, so you don't have to be a tech expert to use them. Download the app (it's free), sign up for an account, and start browsing the retailers. When you're ready to make a purchase, click through the app to the retailer's website and complete your transaction as usual. The cashback amount is credited to your account after the purchase is made and once a certain period of time has passed (to allow for refunds and returns, etc).

3. Additional savings

Some cashback apps offer additional savings opportunities, such as coupon codes, special promotions, and cashback rewards. Grow My Money, for example, offers regular promotions and coupons to help you save even more money on your purchases.

4. Set and forget

By linking a card to your GMM account, you can easily earn cashback in-store without any extra effort. Once you've linked your card, you can purchase at participating stores, like City Chic or Novo Shoes, and receive cashback by simply using your linked card to pay. You won't have to worry about filling out any forms or remembering to activate any offers - it's all automatic! This "set and forget" feature allows you to earn cashback effortlessly, making it a great way to save money without having to do any additional work.

5. Pay off your assets faster

Contributing cashback to your mortgage or superannuation reduces the amount of interest you pay over time.

The above chart assumes your “Paid into My Home" amount plus $30 further cashback rewards paid monthly, a loan amount of $500,000, 30-year term, monthly repayments and annual interest rate of 6% p.a. Source: moneysmart.gov.au

Ready to get started?

Grow My Money is a cashback app offering a unique twist on traditional rewards. With the ability to deliver cashback rewards directly into your mortgage account or superannuation fund, Grow My Money can help you achieve your long-term financial goals faster and more efficiently. So why not sign up and try it and see how much you can save towards your financial future?